Realty Portfolio Diversification: A Smart Technique for Investors

Diversifying your real estate profile is a tried and tested method to alleviate threats and optimize returns. By spreading out investments across various property kinds, places, and markets, financiers can create a secure and successful portfolio. This short article discovers the idea of realty portfolio diversity, its benefits, and actionable suggestions to construct a well balanced portfolio.

What is Property Profile Diversification?

Property portfolio diversification entails buying a mix of properties to minimize dependency on a solitary possession kind or place. Instead of focusing all investments in one building type, such as property or industrial, diversification permits you to leverage possibilities across various sectors and regions.

Advantages of Realty Portfolio Diversification

1. Threat Mitigation

A varied portfolio minimizes the influence of market recessions. As an example, if the domestic market encounters a slowdown, gains in industrial or commercial residential or commercial properties can counter potential losses.

2. Steady Capital

Buying different building types supplies numerous earnings streams. Long-lasting rentals use constant capital, while short-term rentals or holiday residential or commercial properties create greater seasonal income.

3. Access to Development Markets

Expanding geographically allows investors to take advantage of high-growth areas. Arising markets often provide much better returns contrasted to established ones.

4. Property Defense

Spreading out investments across residential or commercial property types and places aids shield your profile from local events like all-natural catastrophes, financial declines, or policy changes.

5. Boosted Returns

Diversity supplies direct exposure to properties with varying recognition prices, enhancing total returns in time.

Ways to Expand Your Realty Portfolio

1. Explore Various Building Kinds

Buy a mix of domestic, industrial, industrial, and retail residential or commercial properties.

Residential Residences: Single-family homes, multi-family systems, or apartment complexes.

Commercial Properties: Office complex, retail rooms, or mixed-use advancements.

Industrial Quality: Storehouses, logistics centers, or manufacturing centers.

2. Branch out Geographically

Expand your investments to various cities, states, and even nations. As an example:

Urban facilities for high rental demand.

Suburbs for family-oriented residential properties.

Vacationer destinations for trip leasings.

3. Take Advantage Of Different Financial Investment Methods

Utilize numerous methods, such as:

Purchase and Hold: For lasting recognition.

Flipping: For fast profits via home restorations.

REITs ( Property Financial Investment Trusts): For hands-off financial investment in diverse residential property portfolios.

4. Buy Emerging Markets

Study and purchase markets with solid economic development, enhancing population, or advancement tasks.

5. Add Property Crowdfunding to Your Profile

Crowdfunding systems provide accessibility to a variety of building investments, consisting of commercial and property tasks, with lower funding needs.

Key Factors To Consider for Real Estate Diversification

1. Marketing research

Understand market fads, home need, and financial factors in prospective financial investment areas.

2. Financial Planning

Examine your spending plan and danger resistance to establish the best mix of residential property kinds and locations.

3. Risk Administration

Usage insurance policy, proper home management, and contingency plans to protect your investments.

4. Expert Support

Team up with property representatives, financial advisors, or investment firms specializing in portfolio diversification.

Examples of Realty Profile Diversity

Study 1: Residential and Commercial Equilibrium

An financier designates 60% of their funds to properties in suburbs and 40% to business properties in urban facilities. This approach supplies constant rental revenue and exposure to higher-yielding industrial spaces.

Study 2: Geographic Diversification

An investor spreads their portfolio across 3 places:

A single-family home in New York.

A holiday leasing in Florida.

A commercial storage facility in Texas.

This geographic variety minimizes risks related to localized economic recessions.

Case Study 3: REITs and Straight Possession

An financier combines direct property possession with REIT investments, acquiring exposure to large business developments without the https://sites.google.com/view/real-estate-develop-investment/ hassle of straight monitoring.

Challenges of Expanding Your Profile

1. Higher First Expenses

Diversification often needs significant resources to purchase multiple properties.

2. Administration Complexity

Possessing homes in various places or kinds may make complex home management and upkeep.

3. Market Volatility

Diversified portfolios might still face volatility because of global financial trends or unforeseen occasions.

Exactly How to Beginning Diversifying Your Real Estate Profile

Set Clear Goals: Specify your economic goals, consisting of anticipated returns and risk tolerance.

Assess Your Current Portfolio: Determine voids or over-concentrations in residential property kinds or areas.

Research Opportunities: Remain Real estate portfolio diversification educated concerning market trends and arising financial investment areas.

Look For Expert Guidance: Seek advice from professionals to optimize your diversity approach.

Display and Readjust: Routinely assess your portfolio to ensure it aligns with your objectives.

Real estate portfolio diversification is a cornerstone of clever investing. By spreading investments across home types, geographic locations, and strategies, you can minimize dangers, rise returns, and make sure long-term security. Whether you're a seasoned investor or just starting, expanding your portfolio is a step towards sustainable wide range development.

Beginning checking out possibilities today to build a robust, diversified realty profile customized to your economic goals.

Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Michael Oliver Then & Now!

Michael Oliver Then & Now! Catherine Bach Then & Now!

Catherine Bach Then & Now! Lacey Chabert Then & Now!

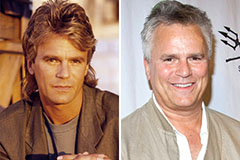

Lacey Chabert Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!